4 swap trading relationship documentation. Any individual registered or seeking registration as an associated person AP of a futures commission merchant FCM introducing broker IB commodity pool operator CPO or commodity trading advisor CTA who intends to engage in swaps activity subject to the.

Is a foreign exchange transaction that occurs sometime in the future C.

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

. 2 margin and segregation requirements for uncleared swaps. No more tokens can ever be minted and the total supply can only be deflated by sending to the dead addressThe tokens will primarily be distributed to presale buyers and the liquidity pool. The swap provider address must be verified on the device before validating the swap.

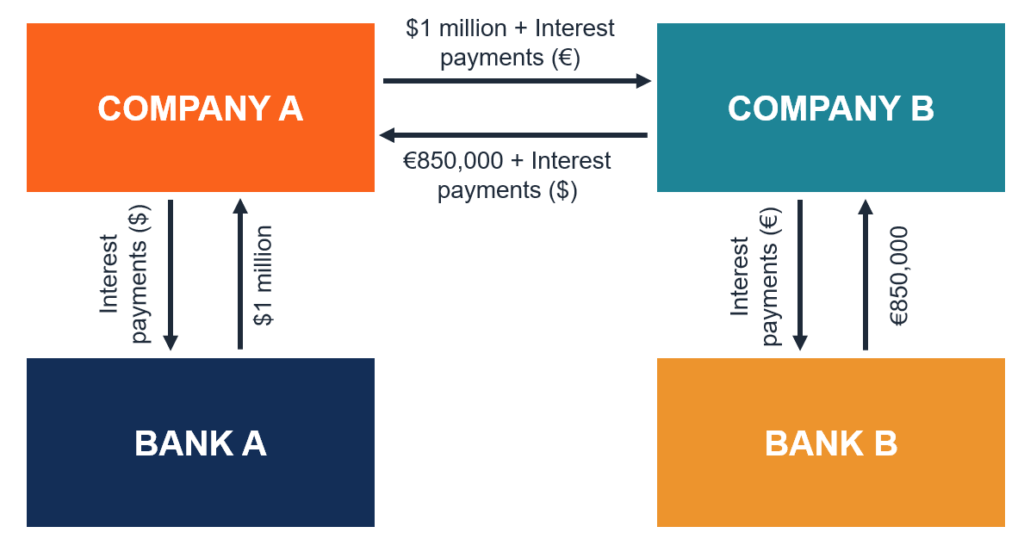

These derivatives are designed to exchange floating cash flows that are based on a commoditys spot price for fixed cash flows determined by a pre-agreed price of a. A foreign currency swap also known as an FX swap is an agreement to exchange currency between two foreign parties. In a currency swap these streams of cash flows consist of a stream of interest and principal payments in one cvtrrency exchanged for a stream of interest and principal payments of the same maturity in another currency.

The most commonly encountered types of currency swaps include the following. R 2 A W 2 A R 2 B W 2 B Possible Serial Schedules are. The Enjoy invoice and credit memo screen transaction consist of the following areas.

One is currency swap and the other is interest swap. The transaction which is part of Gencos efforts to modernize its fleet and create a more focused asset base while reducing its carbon footprint is structured as an asset swap without monetary. TITAN Swap is a decentralized exchange DEX based on AMMs Automated Market Maker AMM mechanism which greatly simplifies the market making process compared to the traditional order book model.

TITAN Swap allows anyone to inject liquidity into the TITAN Pool and earn a profit. Is a foreign exchange transaction that is consummated immediately B. The Trader has support for a smaller number of order types.

SWAP Long Swap This transaction consists of one Swap product for each underlying quoted. There are two types of swap transactions. How many characters does a company-code have-4 - 4.

1 clearing and swap processing. A swap execution facility shall require that a broker or dealer who seeks to either execute against its customers order or execute two of its customers orders against each other through the swap execution facilitys Order Book following some form of pre-arrangement or pre-negotiation of such orders be subject to at least a 15 second time delay between the entry of those two. Involves currencies that are not freely tradeable D.

When the same currency is bought and sold at the same time but delivery is made at two different points in time it is called a swap transaction. The following individuals must satisfy NFAs Swaps Proficiency Requirements prior to engaging in swaps activity. Gas limit - the maximum sum of Gas that must be paid per transaction Gas price - the price set by the user per unit of Gas we will give more detailed definitions below Gas used - the real amount of Gas which was used to process the transaction Transaction fee - the commission per transaction the price is shown in ETH.

They require basic checks to ensure an optimal level of security. - Templates - Header and vendor data - GL account item - Information area UTS 1. One leg of the currency swap represents a stream of fixed interest rate payments while another leg is a stream of floating interest rate payments.

Involves a transaction in which the same currency is bought and sold simultaneously. LunarSwap will save you from that trouble. 6 real-time public reporting.

Swap consists of an agreement hetween two entities called counterparties to exchange in the future two streams of cash flows. The swap points indicate the difference between the spot rate and the forward rate. Which of the following is part of the information required to log on to the SAP system.

Swaps are generally of the following types. The next points are referring to commission. 3 Commodity swap Commodity Swap A commodity swap is a derivative contract that allows two parties to exchange or swap cash flows that are dependent on the price of an underlying asset.

From a users perspective a swap consists of. T1-T2 or T2-T1. On calculation date if the underlying reference price settles above the trade price you receive an amount equal to the underlying reference price less the trade price times the notional quantity.

Currency swap in swap transaction. Two transactions will be. Float swap is commonly referred to as basis swap.

8 Category A Transaction-Level Requirements consist of the following Dodd-Frank Act requirements. In this type of swap transaction the foreign currency rate may be taken advantage of by banks due to the arbitrage. 5 portfolio reconciliation and compression.

These can be better explained with the following examples. Anyswap latest non-custodial cross-chain solution that enables tokens to be swapped between chains. A swap transaction _____.

An all in cost consists of A interest expense B transaction costs C service from FINA 4410 at Northeastern University. In financial markets the two parties to a swap transaction contract to exchange cash flows. A forex swap consists of two legs.

These two legs are executed simultaneously for the same quantity and therefore offset each other. R 1 A W 1 A R 1 B W 1 B T2. An arbitrage is the difference in the exchange rate.

True If the forward price of a foreign-exchange is less than the spot price the currency is selling at a forward premium. The agreement consists of swapping principal and interest payments on a loan. A swap is a custom tailored bilateral agreement in which cash flows are determined by applying a prearranged formula on a notional principal.

R 2 A W 2 A R 1 A W 1 A R 1 B W 1 B R 2 B W 2 B Swapping non-conflicting operations R 1 A and R 2 B in S2 the schedule becomes. The project consists of the following major components working in conjunction. In a basis.

It is a custodial mapping solution that enables tokens to be swapped between chains. Tokenomics LUNAR has a fixed total supply of 10 billion 10000000000 tokens. Types of swap transactions.

A spot foreign exchange transaction and a forward foreign exchange transaction. Signing an outgoing transaction send BTC Providing a receive address receive ETH Most hardware wallet users know that these two operations are sensitive.

How To Fix Pancakeswap Transaction Cannot Succeed Error Fix It Succeed Error

:max_bytes(150000):strip_icc()/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

0 Comments